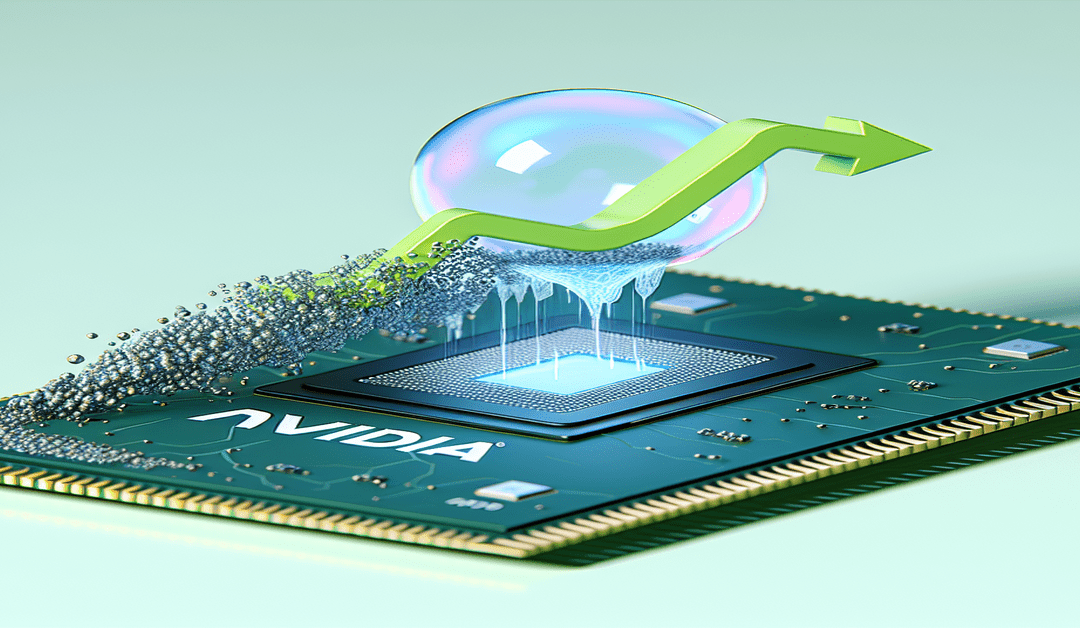

The AI Bubble Burst: Nvidia’s Earnings Report to Confirm Market Slowdown

The artificial intelligence (AI) industry has been riding high on a wave of excitement and investment, with companies like Nvidia (NVDA) leading the charge. However, a prediction has emerged that on August 28, Nvidia’s earnings report will confirm that the AI bubble is in the early stages of bursting. This prediction is based on the assumption that the company’s financial performance will reflect a slowdown in AI-related demand, indicating that the AI market is experiencing a downturn.

The Rise of the AI Bubble

Over the past few years, the AI industry has experienced unprecedented growth, with investors pouring billions of dollars into AI-related companies and projects. The promise of AI to revolutionize industries, automate processes, and create new opportunities has captured the imagination of entrepreneurs, investors, and the public alike.

Nvidia, in particular, has been at the forefront of the AI revolution, with its powerful graphics processing units (GPUs) being used to train and run AI models. The company’s stock price has soared as a result, with investors betting big on the potential of AI to drive future growth.

Signs of a Slowdown

However, there are signs that the AI bubble may be starting to burst. Some experts have warned that the hype surrounding AI has outpaced the reality of its current capabilities and that the market may be due for a correction.

The prediction that Nvidia’s earnings report will confirm a slowdown in AI-related demand is based on several factors. First, there have been reports of companies scaling back their AI investments and projects, as they become more cautious about the return on investment. Second, the global economic slowdown and uncertainties surrounding the COVID-19 pandemic have led to a reduction in overall spending on technology.

Implications for the AI Industry

If Nvidia’s earnings report does indeed confirm a slowdown in AI-related demand, it could have significant implications for the AI industry as a whole. **Other companies** that have heavily invested in AI may also see a decline in their financial performance, leading to a broader market correction.

However, it’s important to note that a slowdown in the AI market does not necessarily mean that the technology itself is flawed or that its long-term potential has diminished. Rather, it may simply reflect a natural correction after a period of **excessive hype** and overvaluation.

The Future of AI

Despite the potential for a market correction, the long-term outlook for AI remains positive. The technology has the potential to transform a wide range of industries, from healthcare and finance to transportation and manufacturing.

As AI continues to evolve and mature, it’s likely that we’ll see a more measured and sustainable approach to its development and deployment. Companies will need to focus on developing **practical applications** that deliver real value to customers and stakeholders, rather than simply chasing the latest hype or trend.

Navigating the AI Landscape

For companies and investors looking to navigate the AI landscape in the coming years, it will be important to stay informed and adapt to changing market conditions. This may involve reassessing investment strategies, focusing on niche applications or markets, or partnering with established players in the industry.

It will also be important to keep an eye on emerging trends and technologies within the AI space, such as **edge computing**, **federated learning**, and **explainable AI**. These areas may offer new opportunities for growth and innovation, even as the broader market experiences a slowdown.

Conclusion

The prediction that Nvidia’s earnings report will confirm a bursting of the AI bubble is certainly noteworthy, but it’s important to keep things in perspective. While a market correction may be inevitable, the long-term potential of AI remains strong.

As the industry matures and evolves, companies and investors will need to adapt and focus on delivering real value through practical applications of AI technology. By staying informed, agile, and focused on the future, they can position themselves for success in the years ahead.

#ArtificialIntelligence #AIBubble #NvidiaEarnings

-> Original article and inspiration provided by Sean Williams

-> Connect with one of our AI Strategists today at Opahl Technologies