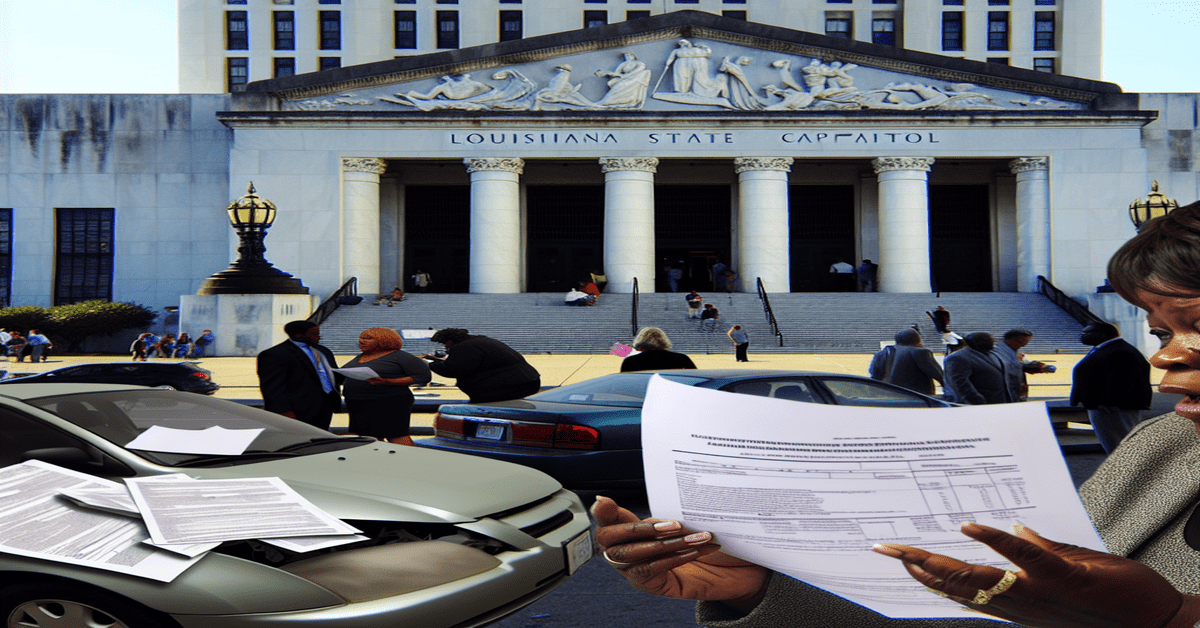

Louisiana House Passes Controversial Car Insurance Bill Amid Heated Debate

In a move that has sparked intense discussion within the insurance industry and among Louisiana residents, the Louisiana House recently passed a controversial bill aimed at tackling the state’s high car insurance rates. The bill, which is part of Governor Jeff Landry’s broader push for insurance reform, has drawn both support and criticism from various stakeholders.

Key Provisions of the Bill

The proposed legislation seeks to grant the insurance commissioner expanded authority to reject auto insurance rate filings that are deemed excessive. Additionally, it would require these filings to be made publicly available, allowing for greater transparency in the rate-setting process. Supporters of the bill argue that insurers in Louisiana are earning higher profits compared to those in other states like Florida or Texas, and that this measure is necessary to protect consumers from being subjected to exorbitant rates.

Opposition and Concerns

However, the bill has faced significant opposition, notably from Insurance Commissioner Tim Temple. Temple contends that the proposed changes could introduce regulatory uncertainty, potentially causing insurers to reconsider their presence in the Louisiana market. Critics worry that an overly aggressive approach to rate regulation might make it more difficult for insurers to operate in the state, leading to reduced competition and, paradoxically, even higher rates for consumers in the long run.

The Broader Context of Insurance Reform

The passage of this bill in the House is just one piece of a larger puzzle when it comes to addressing Louisiana’s car insurance woes. The Legislature is currently grappling with a package of insurance reform measures, which includes proposed changes to tort law and other consumer protections. As the debate continues, stakeholders on all sides are weighing in on the potential impacts of these reforms.

Industry Reactions and Implications

The insurance industry is closely monitoring the progress of this bill and related measures, as the outcome could have significant implications for their business models and profitability in Louisiana. Some industry experts have expressed concerns that the bill’s provisions may disincentivize insurers from offering competitive rates or investing in the state’s market. On the other hand, consumer advocates argue that the current system is broken and that bold action is needed to rein in excessive rates.

The Road Ahead

As the bill moves to the Senate for further review, the debate surrounding Louisiana’s car insurance rates shows no signs of slowing down. Lawmakers, industry representatives, and consumer groups continue to engage in heated discussions over the best path forward. While there is widespread agreement that the state’s high insurance costs are a problem that needs to be addressed, there is far less consensus on the specific solutions that should be implemented.

The outcome of this legislative battle could have far-reaching consequences for Louisiana drivers and the insurance industry as a whole. As an industry expert, I encourage all stakeholders to stay informed, engage in constructive dialogue, and work together to find a balanced approach that prioritizes both consumer protection and market stability. Only by considering the perspectives of all parties involved can we hope to arrive at a solution that will provide long-term relief for Louisiana’s beleaguered drivers.

What are your thoughts on this controversial bill? Do you believe it will effectively address Louisiana’s high car insurance rates, or do you share the concerns raised by its critics? Let me know in the comments below, and be sure to like and share this post to keep the conversation going!

#LouisianaInsuranceReform #CarInsuranceRates #ConsumerProtection

-> Original article and inspiration provided by Opahl Technologies

-> Connect with one of our AI Strategists today at Opahl Technologies