Louisiana House Passes Controversial Auto Insurance Bill: Balancing Cost Control and Consumer Protection

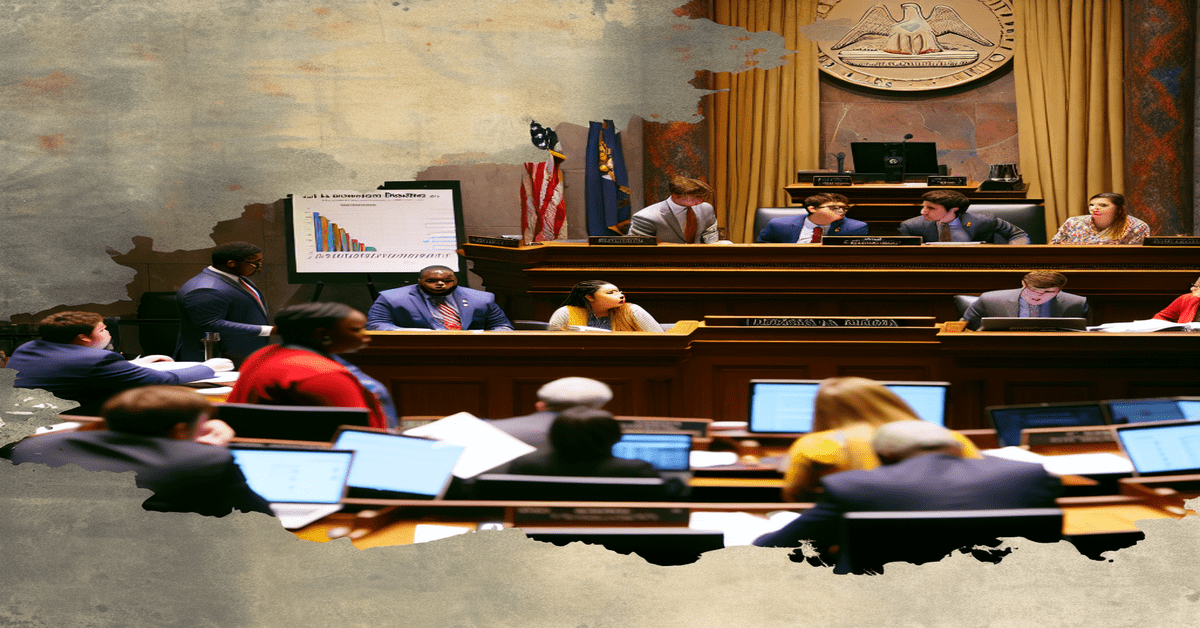

The Louisiana House of Representatives has recently passed a contentious bill that aims to tackle the state’s high auto insurance rates. The proposed legislation seeks to introduce changes in how insurance claims are processed and how rates are determined. Supporters of the bill argue that it will help keep costs under control for Louisiana drivers, while opponents claim that it could potentially lead to further rate increases and diminish consumer protections.

Louisiana has long been known for having some of the highest auto insurance rates in the country, and lawmakers have been grappling with ways to address this issue. The current bill is part of a larger legislative effort to reform the state’s auto insurance market, seeking to strike a balance between cracking down on fraud and abuse within the legal system, which insurers claim contributes to high premiums, and ensuring that victims of accidents receive fair compensation.

Key Points of the Bill

The controversial bill aims to introduce several changes to Louisiana’s auto insurance landscape:

1. Claims Handling: The bill proposes modifications to the way insurance claims are processed, which could impact how quickly and efficiently claims are resolved.

2. Rate Setting: The legislation seeks to allow for changes in how auto insurance rates are determined, potentially affecting the factors that insurers can consider when setting premiums.

3. Cost Control: Supporters of the bill argue that these changes will help control costs for Louisiana drivers, who currently pay some of the highest rates in the nation.

4. Consumer Protection: Opponents of the bill express concerns that the proposed changes could erode consumer protections and shift more of the burden onto policyholders and accident victims.

The Broader Context of Auto Insurance Reform

The passage of this bill in the Louisiana House is just one piece of a larger puzzle when it comes to reforming the state’s auto insurance market. Lawmakers are considering various other bills and reforms during the 2025 legislative session, targeting issues such as:

– Deductible payments

– Policyholder age

– Claims processes

These additional measures demonstrate the complexity of the issue and the many factors that contribute to Louisiana’s high auto insurance rates. Legislators are tasked with finding a delicate balance between implementing reforms that can effectively lower costs for drivers while still maintaining adequate protections for consumers.

The Controversy Surrounding the Bill

The passage of the bill in the Louisiana House has sparked significant controversy, with supporters and opponents fiercely debating its potential impact on the state’s auto insurance market.

Supporters of the bill, including many insurers, argue that the proposed changes will help combat fraud and abuse within the legal system, which they claim has contributed to the state’s high premiums. By introducing reforms to claims handling and rate setting, they believe that costs can be better controlled for Louisiana drivers.

On the other hand, opponents of the bill, including consumer advocates and some lawmakers, express concerns that the legislation could ultimately harm policyholders and accident victims. They argue that the proposed changes could erode important consumer protections and shift more of the burden onto individuals, potentially leading to even higher rates and making it more difficult for victims to receive fair compensation.

The Road Ahead

As the controversial auto insurance bill moves forward in the legislative process, it is clear that there are no easy answers when it comes to addressing Louisiana’s high insurance rates. The debate surrounding the bill highlights the complex and often competing interests at play, as lawmakers, insurers, and consumers all seek to find a solution that balances cost control with adequate protections.

The ultimate impact of the bill, should it become law, remains to be seen. Will it successfully lower costs for Louisiana drivers, or will it lead to unintended consequences that further burden consumers? As the state continues to grapple with this issue, it is crucial that all stakeholders remain engaged in the conversation, working together to find a fair and effective solution that benefits everyone on Louisiana’s roads.

#AutoInsurance #LouisianaLegislature #InsuranceReform #ConsumerProtection

-> Original article and inspiration provided by Tyler Bridges

-> Connect with one of our AI Strategists today at Opahl Technologies