The Homeowners Insurance Crisis: Navigating Rising Costs and Challenges

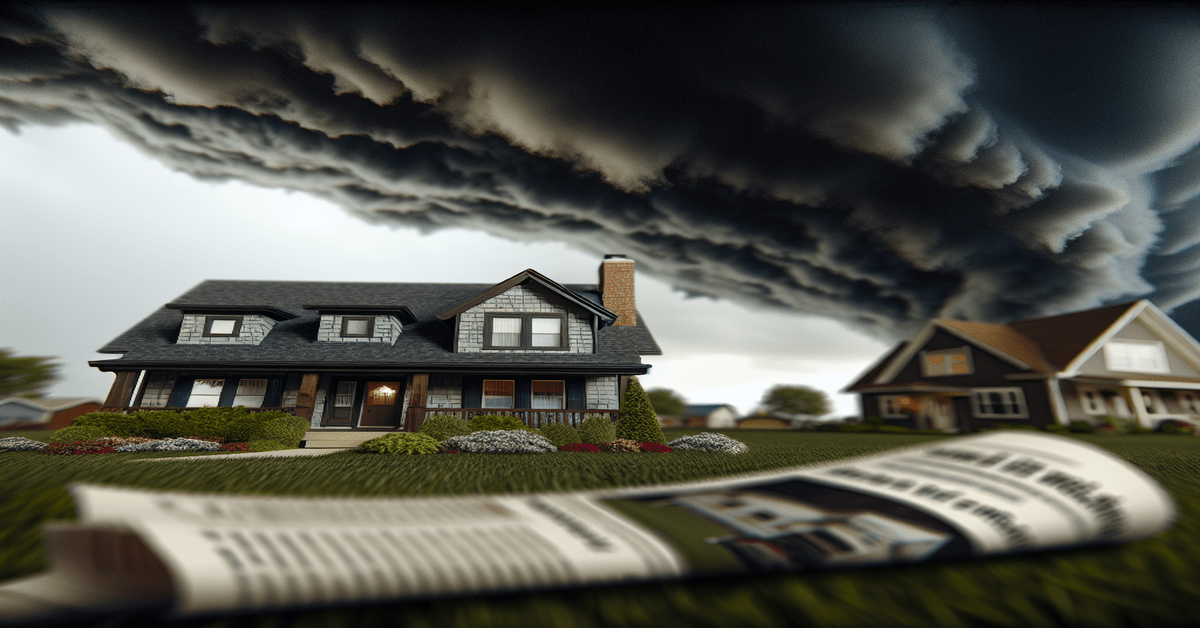

The American Dream of homeownership has long been a cherished aspiration for many, but in recent years, a troubling trend has emerged that threatens to make this dream increasingly unattainable. Homeowners insurance premiums have been on a steady rise, with some regions experiencing alarming spikes that are straining the budgets of countless families. As watchdogs sound the alarm, it’s becoming clear that we are approaching a breaking point in the homeowners insurance market.

A Nationwide Phenomenon

While the issue of rising homeowners insurance premiums is affecting communities across the United States, certain regions have been hit particularly hard. The Upper Midwest, including states like South Dakota, Minnesota, and Montana, has seen some of the sharpest increases in recent years. In South Dakota alone, premiums have skyrocketed by a staggering 41% over the past seven years, far outpacing the rate of inflation[5].

This trend is not limited to the Midwest, however. States like Louisiana and California are also bracing for significant premium hikes in the coming years, with projections suggesting increases of over 20%[2]. The national average for homeowners insurance premiums is expected to rise by approximately 8% in 2025, bringing the average annual cost to a whopping $3,520[2].

The Factors Fueling the Crisis

So, what is driving these alarming increases in homeowners insurance premiums? The answer lies in a complex web of factors, ranging from climate change to construction costs.

One of the primary culprits is the escalating frequency and severity of natural disasters. From devastating wildfires in the West to powerful tornadoes and hailstorms in the Midwest, these catastrophic events are forcing insurance companies to reassess their risk models and adjust premiums accordingly. As the costs of rebuilding and repairing homes continue to climb, insurers are passing these expenses on to policyholders[4][5].

Moreover, the rising cost of construction materials and labor has compounded the problem. In the wake of major disasters, the demand for skilled workers and building supplies often surges, leading to higher prices and longer wait times for repairs. This, in turn, translates to increased claims costs for insurance companies, which are ultimately reflected in the premiums charged to homeowners.

The Ripple Effects on Homeownership

The consequences of this homeowners insurance crisis are far-reaching and deeply concerning. For many families, the dream of owning a home is becoming increasingly out of reach, as the combined costs of mortgages, property taxes, and insurance premiums prove too burdensome to bear.

According to a report by the Consumer Federation of America, homeowners have seen a staggering 24% increase in insurance premiums over the past three years alone, amounting to a total price hike of $21 billion[4]. This added financial strain is not only making homeownership less affordable but also exacerbating the broader housing crisis that has gripped the nation.

As more and more families struggle to keep up with the rising costs of homeownership, the ripple effects are being felt throughout the economy. When people are forced to allocate a larger portion of their income to housing expenses, they have less disposable income to spend on other goods and services, which can dampen economic growth and limit opportunities for businesses to thrive.

Navigating the Challenges Ahead

As we grapple with the realities of this homeowners insurance crisis, it is clear that bold action and innovative solutions are needed to address the underlying issues and provide relief for struggling families.

Policymakers, insurance companies, and consumer advocates must work together to develop strategies that balance the need for financial stability in the insurance market with the imperative of keeping homeownership affordable and accessible. This may involve exploring alternative risk-sharing models, incentivizing risk mitigation efforts, and investing in resilient infrastructure that can better withstand the impacts of natural disasters.

At the same time, homeowners can take proactive steps to protect themselves and their investments in the face of rising insurance costs. This may include shopping around for the best rates, bundling insurance policies, and taking steps to fortify their homes against potential hazards. By being informed, engaged, and proactive, homeowners can navigate these challenges and safeguard their dreams of homeownership.

A Call to Action

The rising costs of homeowners insurance are not merely a financial issue; they are a threat to the very fabric of our communities and the aspirations of countless families. As we confront this crisis head-on, it is essential that we approach it with a sense of urgency, compassion, and determination.

By working together to address the root causes of these premium increases, we can chart a path forward that ensures the American Dream remains within reach for generations to come. It is a challenge that will require bold ideas, tough choices, and unwavering commitment, but it is a challenge we must face if we are to preserve the promise of homeownership for all.

As you navigate the complexities of the homeowners insurance market, remember that you are not alone in this struggle. By staying informed, advocating for change, and making smart choices, you can protect your home, your family, and your financial future. Together, we can weather this storm and build a brighter, more resilient future for all.

#HomeownersInsurance #HousingCrisis #RisingPremiums

-> Original article and inspiration provided by Best American Insurance

-> Connect with one of our Best American Insurance Agents today at Best American Insurance